Investing For Beginners: Start Growing Your Wealth Today

Introduction

In a world where financial stability and wealth accumulation are paramount, investing has become an essential tool for securing one's financial future. Whether you're looking to retire comfortably, buy a home, or achieve any other financial goal, investing can help you get there. However, for beginners, the world of investing can seem daunting and complex. But fear not; this comprehensive guide will walk you through the fundamentals of investing, helping you embark on your journey towards financial prosperity.

Chapter 1: Why Invest?

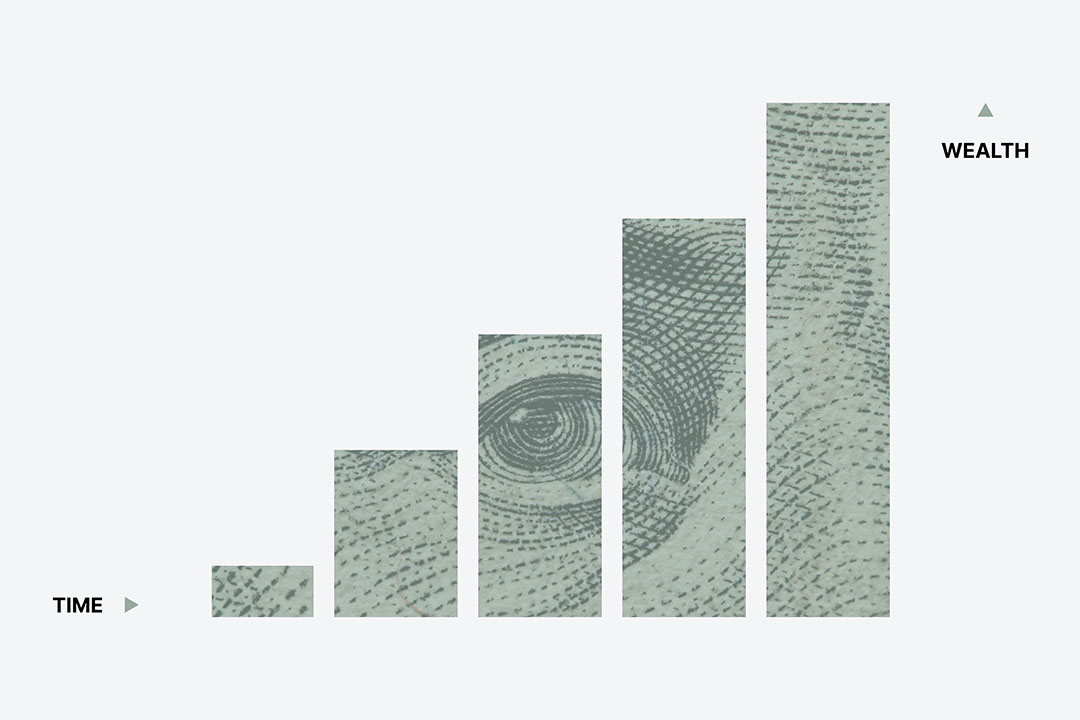

Before delving into the how of investing, let's address the fundamental question: why should you invest in the first place? The answer is simple but profound: investing is a pathway to growing your wealth. Here's why it's so important:

- Wealth Accumulation: Investing allows your money to work for you, earning returns that can outpace inflation. Over time, these returns can significantly boost your wealth.

- Financial Security : Investing provides a safety net for your financial future. It can help you build a retirement nest egg, cover unexpected expenses, or achieve your long-term financial goals.

- Beating Inflation: Money left sitting in a savings account often loses value due to inflation. Investing can help your money grow at a rate that outpaces inflation, preserving your purchasing power.

- Passive Income: Certain investments, like dividend-paying stocks or rental properties, can generate passive income, providing you with a steady stream of money without active effort.

- Diversification: Investing in a variety of assets can spread risk and potentially increase your overall return while reducing the impact of market volatility.

Chapter 2: Setting Financial Goals

Before you start investing, it's essential to define your financial goals. Having clear objectives will guide your investment strategy and help you make informed decisions. Here are some common financial goals:

- Retirement: Saving for retirement is a top priority for many investors. Calculate how much you'll need to retire comfortably and set this as a long-term goal.

- Emergency Fund: Build an emergency fund that covers at least three to six months' worth of living expenses. This fund should be easily accessible, typically in a high-yield savings account.

- Buying a Home: If you plan to buy a house, determine how much you'll need for a down payment and when you'd like to make the purchase.

- Education: If you have children, consider saving for their education, whether it's college or vocational training.

- Debt Reduction: Prioritize paying off high-interest debts, such as credit card balances, as part of your financial goals.

Chapter 3: Understanding Risk and Reward

Investing inherently involves risk, and it's essential to understand the relationship between risk and reward. In general, investments with higher potential returns also come with higher levels of risk. Here are some key concepts to grasp:

- Risk Tolerance: Assess your risk tolerance, which is your ability and willingness to endure the ups and downs of the market. Your risk tolerance should align with your financial goals.

- Asset Classes: Different asset classes, such as stocks, bonds, real estate, and commodities, carry varying levels of risk and potential reward.

- Diversification: Spreading your investments across different asset classes and individual investments can help reduce risk.

- Time Horizon: Consider your time horizon for each financial goal. Longer time horizons typically allow for a more aggressive investment strategy, while short-term goals may require a more conservative approach.

Chapter 4: Investment Options

Now that you've laid the groundwork, let's explore some common investment options for beginners:

- Stocks: Buying shares of a company makes you a partial owner. Stocks offer the potential for high returns but also come with greater volatility.

- Bonds: Bonds are debt securities issued by governments or corporations. They provide regular interest payments and are generally considered less risky than stocks.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer diversification and professional management.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They provide diversification and often have lower fees than mutual funds.

- Real Estate: Investing in real estate can involve purchasing physical properties or investing in real estate investment trusts (REITs), which are companies that own and manage income-producing real estate.

- Savings Accounts and Certificates of Deposit (CDs): These are low-risk, low-reward options that provide a safe place to park your money but offer minimal returns compared to other investments.

Chapter 5: Building a Diversified Portfolio

Diversification is a crucial strategy for managing risk in your investment portfolio. Here's how to build a diversified portfolio:

1. Asset Allocation: Allocate your investments across different asset classes based on your risk tolerance and financial goals. For example, a young investor with a long time horizon might have a higher allocation to stocks, while someone nearing retirement may have more bonds.

2. Individual Investments: Within each asset class, diversify further by investing in different individual securities. For stocks, this might mean owning shares of companies in various industries.

3. Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation. This involves selling assets that have performed well and buying those that have underperformed.

Chapter 6: Getting Started

Now that you have a good grasp of the basics, it's time to take action and start investing. Here's a step-by-step guide:

- Open an Investment Account: Choose a brokerage or investment platform that suits your needs. Look for one with low fees, a user-friendly interface, and access to the types of investments you want.

- Fund Your Account: Deposit money into your investment account. You can start with as little or as much as you're comfortable with.

- Select Investments: Based on your financial goals and risk tolerance, choose the investments that align with your strategy. Consider using low-cost index funds or ETFs for simplicity and diversification.

- Monitor and Adjust: Regularly review your portfolio to ensure it aligns with your goals and risk tolerance. Make adjustments as needed.

- Stay Informed: Continue learning about investing and financial markets. Stay informed about economic news and how it might impact your investments.

Chapter 7: Common Mistakes to Avoid

Investing for beginners often comes with pitfalls. Here are some common mistakes to steer clear of:

- Overtrading: Resist the urge to buy and sell frequently. Frequent trading can lead to higher fees and taxes, potentially eroding your returns.

- Ignoring Fees: Pay attention to the fees associated with your investments. High fees can significantly reduce your returns over time.

- Chasing Hot Trends: Avoid investing based solely on recent market trends or media hype. Stick to your investment plan.

- Lack of Diversification: Failing to diversify your portfolio can expose you to unnecessary risk. Ensure your investments are spread across different asset classes.

- Emotional Investing: Don't let fear or greed drive your investment decisions. Emotions can lead to impulsive actions that harm your portfolio.

Conclusion

Investing for beginners may seem intimidating at first, but it's a journey well worth

taking. By setting clear financial goals, understanding risk, diversifying your portfolio, and staying informed, you can begin your path to growing your wealth. Remember that investing is a long-term endeavor, and patience is key. Start small, learn as you go, and watch your wealth gradually grow over time. With the right approach and commitment, you can secure a brighter financial future for yourself and your loved ones.

Happy investing!